november child tax credit schedule

The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. Child Tax Credit Payment Schedule for 2021.

Pin On Family Economic Security

They could also get up to 250 per qualifying child between 6 and 17 years or a total of 3000.

. December 13 2022 Havent received your payment. The deadline for the next payment was November 1. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon.

Fast And Easy Tax Filing With TurboTax. The advance is 50 of your child tax credit with the rest claimed on next years return. Your next child tax credit payments could be worth 900 per kid Credit.

That will be the sixth and final monthly payment this year. Wait 5 working days from the payment date to contact us. The credit amount was increased for 2021.

For the current tax season the IRS has announced f you claimed the Earned Income Tax Credit EITC or the Additional Child Tax Credit ACTC you can expect to get your. For each qualifying child age 5 and younger up to 1800 half the total. Advance Child Tax Credit.

Goods and services tax harmonized sales. November 18 2022. The American Rescue Plan increased the amount of the Child Tax.

Getty For qualified families who opted for paper checks those will begin to hit mailboxes through the. The next batch of child tax credit payments is scheduled for December 15. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

IR-2021-222 November 12 2021. The advance is 50 of your child tax credit with the rest claimed on next years return. Your child tax credit checks may have been less or more than you expected.

Child tax credit payment schedule. Ad The new advance Child Tax Credit is based on your previously filed tax return. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic E These updated FAQs were released to the public in Fact Sheet.

However for some families the monthly. The amount of credit you receive is based. If you meet all of the child tax.

Specifically the Child Tax Credit was revised in the following ways for 2021. Tax return filers claiming Additional Child Tax Credits ACTC and Earned Income Tax Credits EITC may have their refunds held up by the IRS for several weeks. The IRS will send out the next round of child tax credit payments on October.

By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

Child Tax Credit Update Next Payment Coming On November 15 Marca

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week

Child Tax Credit Schedule 8812 H R Block

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

The Child Tax Credit Toolkit The White House

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

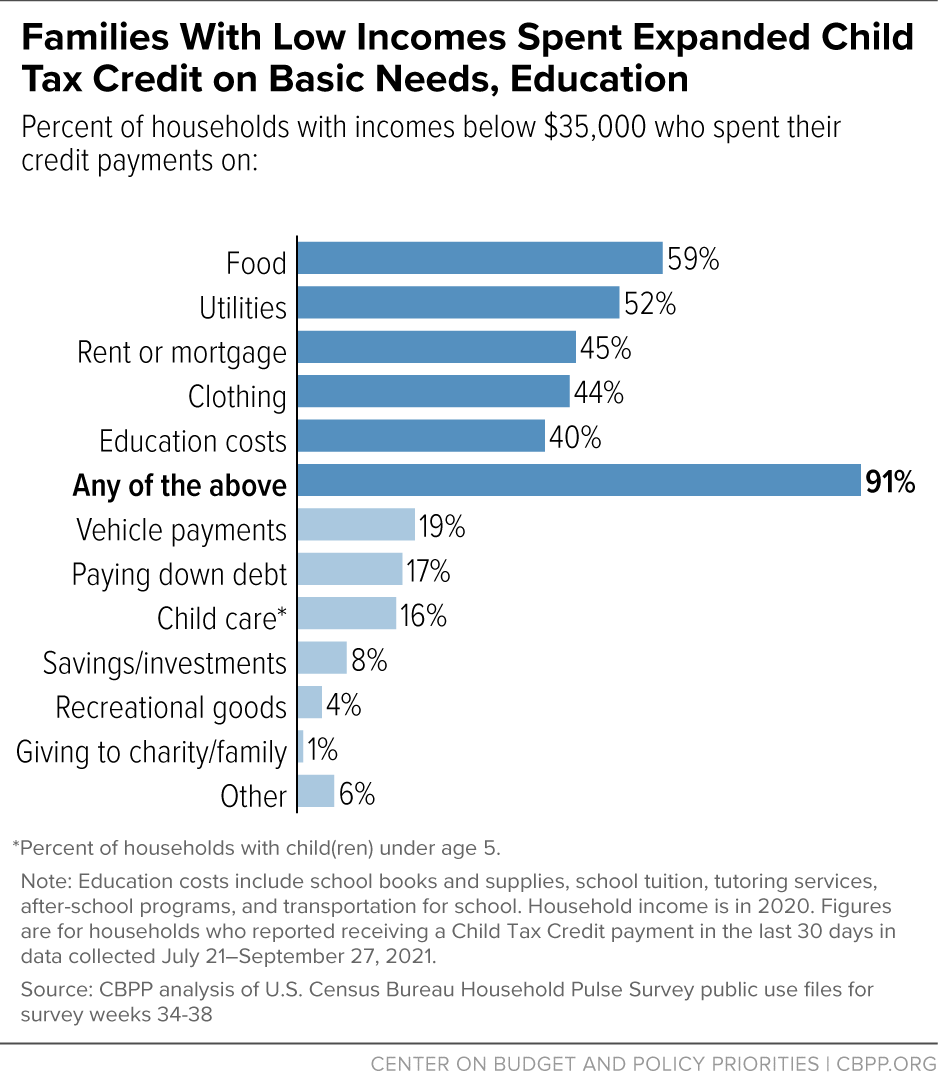

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The Child Tax Credit Toolkit The White House

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters