revolving open end credit example

In an open-end credit plan. Credit cards are the most popular example of revolving credit and Americans are awash in debt because of them.

Open-end credit examples Home equity lines of credit or HELOCs.

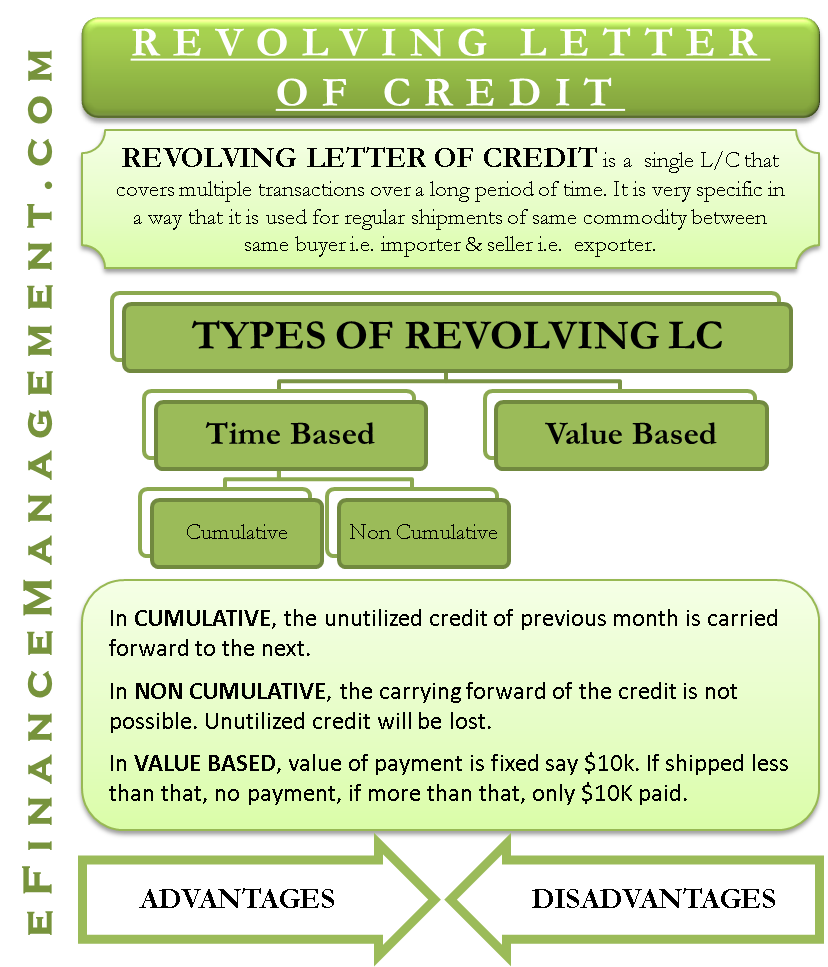

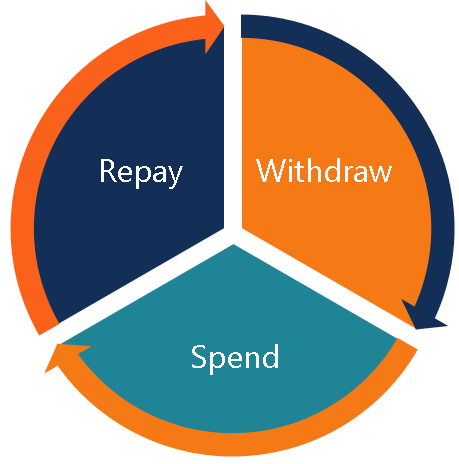

. Revolving credit is a type of debt generally associated with credit cards because as consumers pay down their balance each month they are able to incur more charges. As you repay what youve borrowed you can draw from the credit line again and again. Rising from 9084 billion at end of the first quarter in 2017 to 10285.

Once a borrower pays off the 30000 owed the line of credit remains open for re-borrowing later making the line of credit revolving in nature. Service station credit cards. Summary An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit.

Suppliers frequently extend short-term credit to encourage sales to retailers. The following are all types of open-end credit. Other types of revolving credit include lines of credit such as a home equity line of credit commonly known as a HELOC.

With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next. Model clause b is for use in connection with other open-end credit plans. Depending on the product you use you might be able to access the funds via check card or electronic transfer.

There are different possible ways to draw money from an accounts credit line like a transfer to your. With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment. Write the word or phrase that best completes each statement or answers the question.

Examples A credit card with revolving credit. A common type of open-end loan is a line of creditOpen-end loans can also take the form of credit cards or home equity lines of creditWith open-end loans borrowers can spend money up to a. Model clause a is for use in connection with credit card accounts under an open-end not home-secured consumer credit plan.

Many people use credit cards to make everyday purchases or pay for unexpected expenses. Whats an example of open end credit. See interpretation of this section in Supplement I.

Examples of open-ended credit include the following. Overdraft protection for checking accounts. Use the discriminant to determine the number and nature of the solutions to the quadratic equation.

Revolving open-end credit typically does not specify a maximum amount that can be borrowed. This allows borrowers to access as much or as little funds as they chose depending on their current needs. Home equity lines of credit HELOCs.

Credit cards are an example of revolving open-end credit. L the creditor permits the customer to make purchases from time to time as the plan provides. Some credit cards come with rewards and benefits you can use to your advantage.

Open-end credit examples. Open-end credit is a line of credit that can be used over and over again examples include credit cards revolving accounts and home equity lines of credit. An open-ended loan is a loan that does not have a definite end date.

Here are some key things to know about how revolving credit accounts work. How does revolving credit work. Three types of revolving credit accounts you might recognize.

Examples of open-ended loans include lines of credit and credit cards. C If the balance is not paid off over a period of months a penalty is incurred. 2 the customer may pay the balance in full or in installments.

Open-end credit also is referred to as a line of credit or a revolving line of credit. An open-end loan is a revolving line of credit issued by a lender or financial institution. Department store credit cards.

Depending on the type of credit account you have how and when you draw money from your revolving credit account can differ. Credit cards are examples of open-end credit. With a HELOC the borrower receives a loan in the amount of the equity on her house and puts up.

B A specific maximum amount of credit is established. Open-end credit sometimes called revolving credit is a type of credit whereby youre given a spending limit and you can spend up to that amount but dont take all the money at once. Department store credit cards.

Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open-end credit though some like the HELOC have finite payback periods. Common examples of open-end credit are credit cards and lines of credit. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes.

The credit limit is established by the lender and can increase or decrease. In order to have good credit in the future you must have used it wisely in the past. A credit line that you use at a supplier.

Which of the following is not true regarding revolving open-end credit. You may still owe on one purchase while you are purchasing yet another shipment. Credit cards personal lines of credit and home equity lines of credit are some common examples of revolving credit accounts.

Sample G-24 includes two model clauses for use in complying with 102616h4. When you carry a balance on a revolving account youll likely have to pay interest. With some forms of open-end credit theres no end date.

With open-end loans like credit cards once the borrower has started to pay back the balance they can choose to take out the funds againmeaning it is a. There are three common examples of revolving lines of credit. Personal lines of credit.

Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of. A Credit cards are an example of it. Home equity lines of credit or HELOCs.

What is a open-end loan. Call this revolving credit because unlike a conventional bank loan with a pre-determined payoff date payment on revolving credit it is open ended. The issuing bank.

And 3 a finance change may be. Is a mortgage an open end credit. Examples of an Open-End Loan.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

Revolving Credit Personal Credit Loans Lines Of Credit

What Is Open End Credit Experian

Revolving Credit Vs Line Of Credit What S The Difference

Types Of Credit Definitions Examples Questions

How Revolving Credit Works Howstuffworks

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)